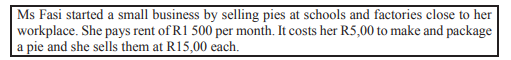

2.1

Study the table below and answer the questions that follow.

TABLE 2: THE COST AND INCOME FOR THE BUSINESS

The following formulae are used to calculate the cost and income respectively:

Cost = R1 500 + R5,00 x n

Income = R15,00 x n; where n represents the number of pies

2.1.1 Use the table to determine Ms Fasi’s break-even amount. (2)

2.1.2 Calculate the value of A. (3)

2.1.3 Show by means of calculations that the value of B is R3 750. (2)

2.1.4 Calculate the profit if 350 pies are sold. (3)

2.2 Ms Fasi borrowed R60 000 from Women’s Bank to start her small business and agreed to pay back the money at an interest rate of 8,5% that is compounded annually for 2 years.

2.2.1 Calculate the amount of the interest that was added at the end of the first year. (2)

2.2.2 Determine the total amount that Ms Fasi paid back to the bank after 2 years. (5)

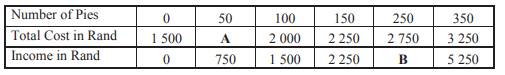

TABLE 4: Water meter readings for Account Number 40101607 during May and June.

2.3.1 Calculate the cost of the water usage for May 2018 excluding VAT. (5)

2.3.2 Calculate the VAT amount that is charged on the additional charge of R80,70. (VALUE ADDED TAX = 15%) (3)

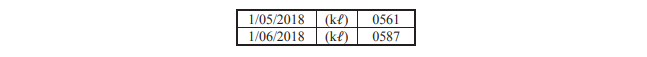

2.4 The average inflation rates for the period 2016 to 2017 are shown in the following

table.

2.4.1 Explain the meaning of the term inflation rate. (2)

2.4.2 Calculate the cost of a loaf of brown bread in 2017 by using the average inflation rates that are given in the table above. (2)

[29]