ANNEXURE A shows Dean’s clothing store statement from Markham for a certain period of the year.

Use ANNEXURE A to answer the questions that follow.

2.1.1 Write down the total balance owing on Dean’s account. (2)

2.1.2 Give the full date on which the current installment is due. (2)

2.1.3 State the opening balance of the 12-month revolving account option. (2)

2.1.4 Write down the price of the item that was returned. (2)

2.1.5 Determine the total amount paid using FNB electronic payments. (3)

2.1.6 The selling price of an item includes 15% VAT. (3)

Calculate the price of the item purchased on 19 December 2018, excluding VAT.

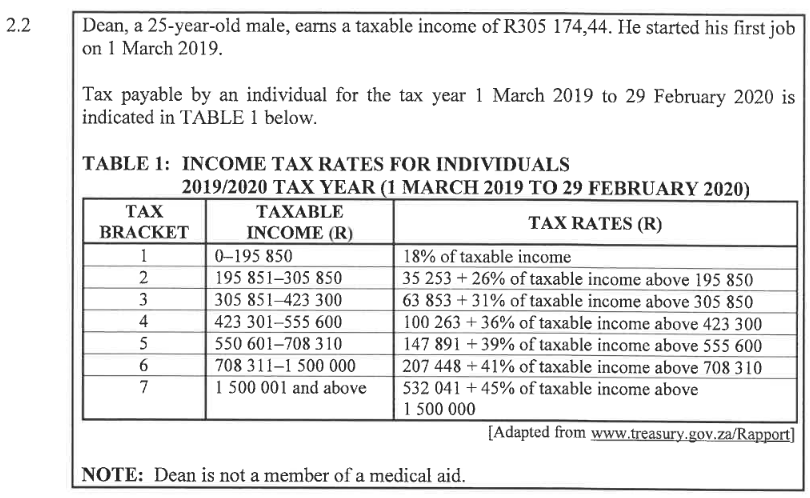

Use TABLE 1 to answer the questions that follow.

2.2.1 Name the government institution responsible for collecting tax return forms. (2)

2.2.2 Write down the tax bracket that will be used to calculate Dean’s tax payable. (2)

2.2.3 Calculate the monthly tax payable by Dean before any rebates are deducted. (5)

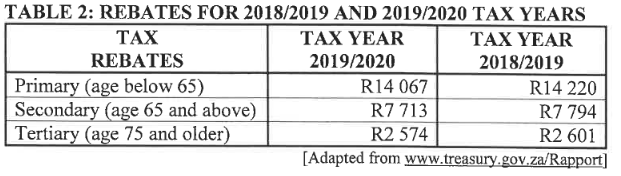

2.2.4 TABLE 2 below indicates the rebates for the 2018/2019 and 2019/2020 tax years.

(a) Identify the tax rebate(s) that Dean qualifies for in the 2019/2020 tax year. (2)

(b) State the number of tax rebates a 75-year-old man will qualify for in any tax year. (2)

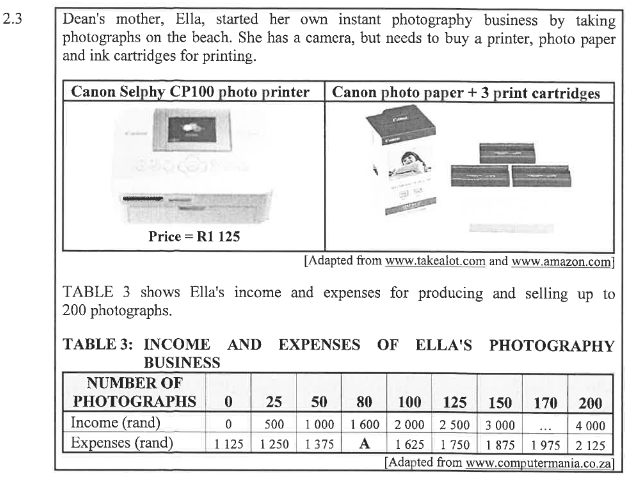

Use TABLE 3 above to answer the questions that follow.

2.3.1 Determine the selling price of ONE photograph. (2)

2.3.2 Write down the formula that could be used to calculate the total income received. (2)

2.3.3 The total expenses can be calculated using the following formula:

Expenses (in rand) = 1 125 + number of photographs X5

(a) Write down the variable cost for taking ONE photograph. (2)

(b) Calculate missing value A. (3)

2.3.4 ANNEXURE B shows two graphs, X and Y, which can be used to represent the business.

Use ANNEXURE B to answer the following questions.

(a) Give a suitable heading for the graphs that were drawn. (2)

(b) State which graph (X or Y) represents the income received by the business. (2)

(c) Determine how many photographs must be sold to break even. (2)

[42]